Due to rapid globalization, shipping silver or any other precious metal from India to USA is no longer impossible. Still, this procedure calls for rigorous compliance with adoption and control measures in both countries, as well as a selection of appropriate packing methods as well as international couriers that can successfully deliver the parcel. This guide walks through the entire process of shipping silver from India to the USA, from getting the right courier to meeting the customs policies of the latter country, in a comprehensive manner.

1. Understanding the Courier’s Instructions Regarding Mercury, Gold, and Silver

Given that not every courier service is capable of accepting packaging that contains valuable metal, it is crucial to ensure that the appropriate service is used. There are several international couriers, including FedEx, UPS, DHL, and other valuable transporters like Overseas Logistics, who have a niche in such items and cargo shipping. When looking for a courier, be sure to ask about the following:

Experience in Sending High-Value Items: Do not hesitate to ask whether the firm has prior knowledge of transporting silver or any other pieces of gold out of the borders.

Tracking and Security: These services are now available, and it is wise to choose from couriers who provide them, together with tracking systems, as one is able to see his or her valuables.

Policies for Specialized Insurance: It is important to know that not all standard courier insurance covers valuable items such as silver. One must select a courier that provides added protection based on the worth of the shipment.

Keep in mind, though, that while using different courier services, they have certain restrictions on weight, size, and even value, so verify these beforehand to avoid hitches at the last moment.

2. Proper Packaging. Protecting Your Silver During Transit to India

When silver is transported, appropriate packaging is critical to reducing the risk of physical damage or loss whilst in the care of others and within the supply chain. In this detail, be sure to observe the following factors during packaging:

Employ Padded Packaging: A layer of bubbled wrap should be the first thing that goes over the silver items; otherwise, they are likely to obtain scratches or dents. Additional padding should be placed in order to absorb shocks that occur during transportation.

Reinforced Packaging: A more robust outer box or layer which is tamper-resistant should be used. A lot of experts recommend stronger cardboard outer boxes or even metal ones for packaging precious metals.

Sealing: Make sure the package is tightly sealed with strong tape. Otherwise, it might open by itself. In order to prevent tampering with the package, one may want to utilize tamper-evident security tape.

Discreet Labeling: Do not label the parcel and say “silver” or “jewellery”, for example. It is wise to label the parcel; otherwise, it takes away the attention from the contents present inside.

3. Declaring Your Shipment: Avoiding Hurdles in Customs with Clarity of Purpose

When exporting silver from India to the USA, it is imperative to pay attention to the authenticity of the documents provided in order to meet customs requirements and avoid any inconvenience:

Description of Contents: Silver item(s) must be elaborated on in the customs declaration with a proper description. Use “silver jewellery,” “silverware,” “silver coins,” and “silver” where necessary for additional explanation of Silver Coins.

Declared Value: This covers the value of the merchandise and will make things easier at the customs and expedite their processing. This avoids additional import duties and taxes or facilitates the customs clearance of any that are required.

Certificate of Origin: Silver of domestic origin is preferable; a certificate should be provided if available. Especially for high-value shipments, some customs offices may require the same.

Invoice or Purchase Receipt: Even for retail or new silver items, a copy of the invoice should be enclosed, or a proof of purchase should be supplied. It substantiates the factual value stated and helps facilitate the customs check.

4. Custom Duties and Taxes: What You Must Know About Financial Aspects

Transporting silver to the USA is coupled with dealing with customs duty and taxes. The U.S. Customs and Border Protection (CBP) has import duties for certain procured items, but there are provisions and factors regarding silver:

Duty-free Exemption: In the USA, goods that have a value of not more than $800 do not attract import duties, and this is advantageous for some silver, e.g. small or low-value items.

Duty Rates: If the value of your shipment is less than $800, it will not attract duties. However, if the value exceeds $800, duty rates may be imposed. The rate is approximately 5% for silver jewellery but may differ with item type and country of manufacture.

Other Costs: Expect most other fees like processing fees or merchandise handling fees that may be charged at customs. These depend on the courier service and the route taken.

5. Insurance: Your Shield Against Risk and Loss

When shipping valuables such as silver, it is advisable to insure them to avoid risks such as theft, damage, or loss during transit. It is normal for most couriers to provide insurance for silver items they ship, and this coverage is normally limited to the item’s stated worth. Below are the steps to take when insuring for shipment:

Consider Your Coverage Needs: Think about the manner of silver you want to ship, its value, and if it can be replaced. When dealing with works of art of significant worth, a more thorough insurance coverage with a wider scope may be needed.

Review Any Existing Coverage: Homeowners or personal property insurance may have some provisions that allow bills of lading for high-value items shipped overseas. Contact your insurer for a better understanding.

Insurance Extensions: Where the insurance coverage provided by the default insurance policy of your chosen order courier is inadequate, look for an add-on policy. There are several couriers that offer high coverage for add-ons to such items that have a high value.

6. Restrictions and Compliance: Sending Items to Other Countries

Even though silver, in most cases, can be exported out of India freely, there are some restrictions or prohibitions on exporting certain silver-manufactured items. The following things must be noted:

Cultural and Historical Artifacts: Historical or cultural artefacts can sometimes be restricted or require special permits. If any of your silver items happen to be antique or items with relevant historical value, seek permission to export.

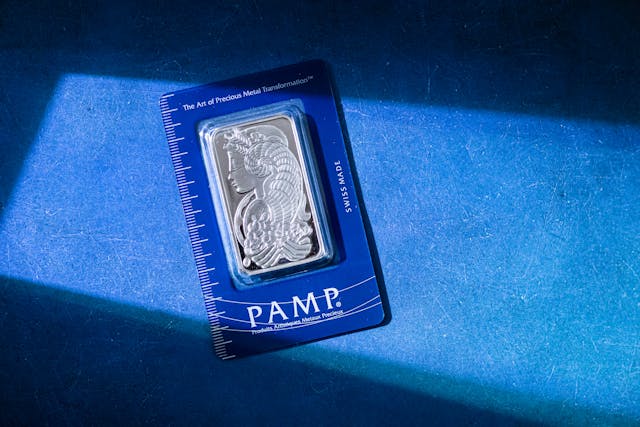

Banned Items: Some silver articles, like silver coins or bullion, may have some limitations or need further documentation. Check with the courier and customs for any restrictions regarding the shipment.

Customs Regulations in Both Countries: Indian and U.S. customs offices, if required to check up, do so in advance as countries differ in the imports regarding silver articles.

Final Thoughts

Transporting silver to the USA from India demands considerable thought and attention to laws. From the choice of reliable carriers to the proper packing, paperwork, and insurance, each one of them is significant even for the successful delivery. Customs duties and restrictions can also be taken into account in order to avert unwanted delays and expenses and make it possible for silver of great value to be transported in a safe and legal manner.

These are the general guidelines recommended during the exportation process; utilize them whenever transporting silver jewellery, silverware or other silver items. In this way, the shipping process can be efficient and seamless. Planning and meticulous execution allow the silver shipment to cross continents for the benefit of the recipient.

Also Read:

Can I Courier iPhone from USA to India

How to Send Jewellery by Courier in India

Courier Clothes from India to USA

Send Medicines From India to USA

Can I Send a Watch by Courier to India?